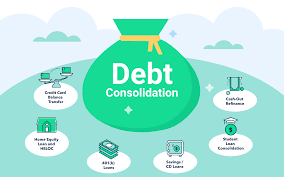

Debt consolidation combines multiple debts into a single, manageable loan with a lower interest rate. It can simplify your monthly payments and help you pay off your debt faster. However, debt consolidation is not for everyone. Here’s what you need to know before considering it.

- Assess if your interest rates are high: Consolidating is most beneficial if it lowers your interest rate.

- Choose the right consolidation loan: Compare personal loans, balance transfer credit cards, or home equity loans.

- Evaluate fees and terms: Be sure the loan terms align with your financial goals and budget.

- Avoid accumulating more debt: Once consolidated, resist the temptation to take on new debt.

- Understand the impact on credit: Consolidation may affect your credit score, but timely payments can help improve it over time.